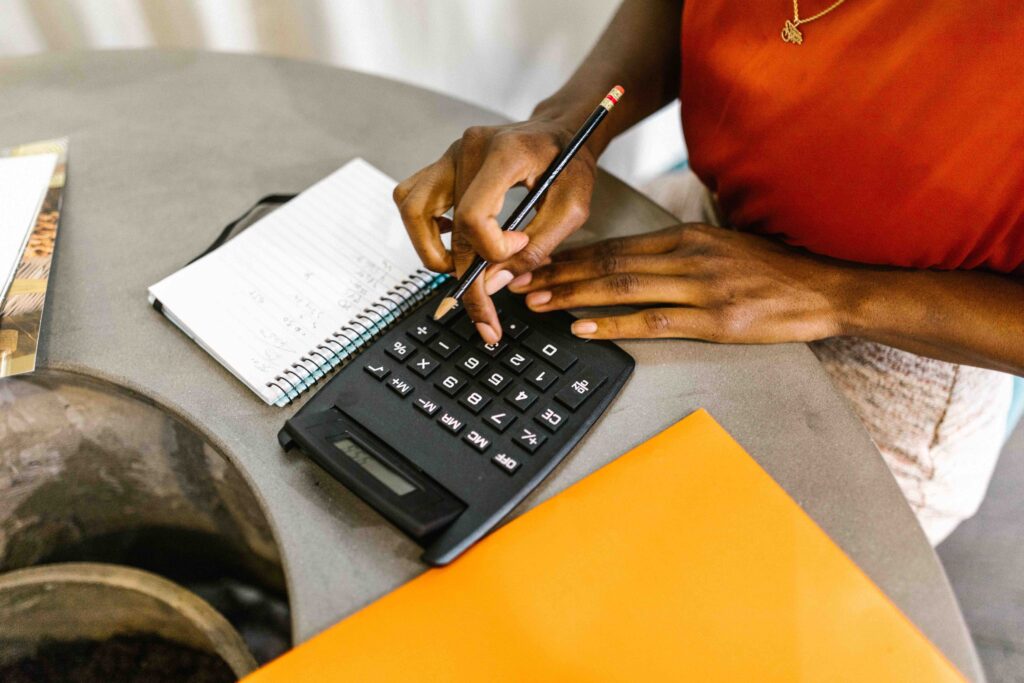

Top financial planning tips for the sandwich generation

With a little financial planning, you can make the transition into caring for your parents and for your children a little easier and a lot less stressful, without putting your own retirement plans at risk.

Even on the best of days, life can be hectic and overwhelming. Jobs and general day-to-day responsibilities aside, many of us have kids to take care o,f which comes with its own subset of duties and expenses. When you add the responsibility of caring for older family members it can be a lot to handle.

You may be part of a growing number of Canadians who find themselves as members of the “sandwich generation” – those juggling both the needs of their children and their parents at the same time. In fact, one in four Canadians currently find themselves in the position, according to a story published by McMaster University’s Brighter World.

Serious financial pressure and emotional demands from all corners amount to overwhelming stress. Something’s got to give. The good news is that with a little financial planning, you can make the transition into this new phase of your life a little easier and a lot less stressful, without putting your own retirement plans at risk. Here are a few suggestions to help prepare for the new responsibilities.

Organize and update your financial position.

Just as you should “always put your own oxygen mask on first before helping those around you," the same holds true for your personal finances. That’s why planning is critical. And, because you’ll have your hands full with your daily routine, it’s a good idea to get a jump on creating efficiencies now while you still have a little breathing room.

Make sure that all tax documentation is organized and filed and that wills and powers of attorney are current and relevant. Is your financial plan being monitored and implemented? Do you have an insurance plan in place to provide risk management? Make sure all banking records and other accounts are organized and stored in one safe place.

Here are a few other questions to ask yourself:

- Emergency preparedness: do you have at least six months of living expenses saved in case a crisis arises?

- Retirement: are you maximizing your annual RRSP contributions?

- Income/cash flow: do you have a handle on your monthly income and general expenses?

- Future expenses: what kind of expenses do you have on the horizon?

It would be helpful to streamline and simplify your finances. For example, get rid of multiple credit cards and multiple bank accounts at different institutions. Working with one professional that can quarterback all these elements would be a wise idea.

Understand your parents’ financials and legacy wishes.

Once you’ve taken the time to go over your personal finances, it’s time to do the same with your parents. It may feel challenging to have a conversation with your parents about their income and investments, but it is a critical first step.

Income: find out exactly how much money they have coming in every month from pensions or any other sources.

Monthly expenses: make a list of all their monthly expenses, being sure to include health care, insurance, and medications.

If they already have an estate plan in place, take some time to understand your parents' legacy wishes and who they wish to take care of their health and property in case of incapacitation. Then, with professionals, help them review their estate documentation to make sure it is reflective of their wishes.

Encourage adult children to contribute.

Though it will likely be a difficult subject to broach, urge adult children still living at home to contribute financially as they move closer to independence. There are many ways to go about it, but the easiest would be to have them start paying for room and board.

Share financial responsibilities.

While life can seem overwhelming and chaotic at first, turning the tables and getting hold of it all is easier than you think. The key is to ask for help when you need it. Juggling financial planning on top of everything else can take its toll and overextending yourself can make it more challenging to meet your responsibilities, including caring for loved ones.

Explore the possibility of sharing the caregiving and financial planning responsibilities with siblings or other members of the family, if possible. And be sure to set limits – it can help relieve some of the uncertainty about your financial role and encourage others to pitch in when needed.

Get estate planning in order.

Do you have a will? Do your parents have a will? How can you make sure your kids are taken care of in case the unforeseeable happens? These are all important questions to ask yourself and good reasons to get your estate planning in order, sooner rather than later. Ensure you have all important documents organized for both your parents and your own family. These include wills, trusts, advanced care arrangements, life insurance, powers of attorney and a named executor to carry out important tasks

And, lastly, get help! Don’t be afraid to reach out to a financial professional. They can help you get to a place of confidence so that you feel better about your family’s financial future. They can give you a second opinion on your current financial plan and work with you to develop strategies to manage your finances as your goals change.

Georgia Corkins is an investment advisor and financial planner for BMO Nesbitt Burns. She has been an advisor for 32 years and works on a broad range of solutions for her clients’ financial needs.